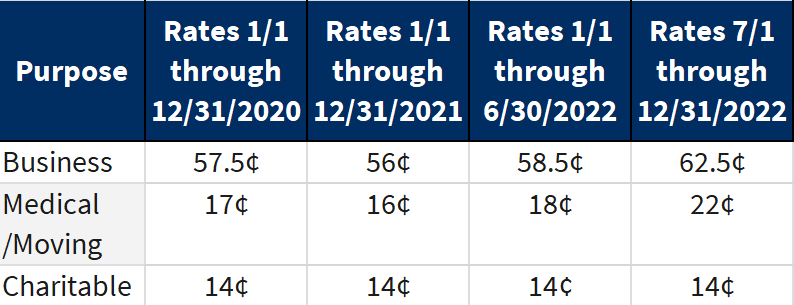

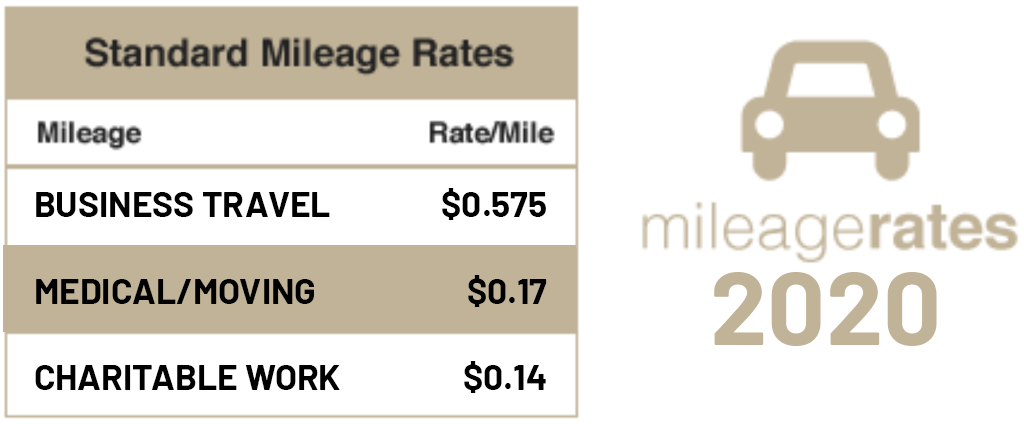

The 2023 standard mileage rates are: - 65.5 cents per mile driven for business use - 22 cents per mile driven for medical or moving purposes for qualified active-duty members of the

Your Money Per Mile: Standard Mileage Rates For Tax Deductions (Updated For 2022) - Silver Tax Group